BTC/HKD-4.19%

BTC/HKD-4.19% ETH/HKD-5.64%

ETH/HKD-5.64% LTC/HKD-4.12%

LTC/HKD-4.12% ADA/HKD-7.34%

ADA/HKD-7.34% SOL/HKD-11.32%

SOL/HKD-11.32% XRP/HKD-6.64%

XRP/HKD-6.64%在結束兩天的會議后,北京時間今天凌晨,美聯儲宣布加息25個基點。

這是2018年以來美國首次加息。

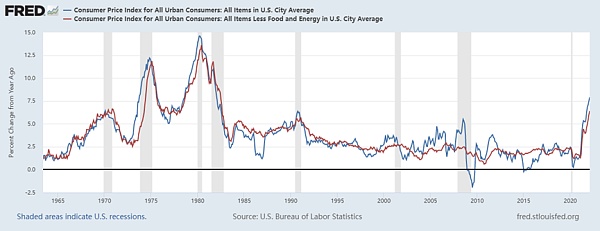

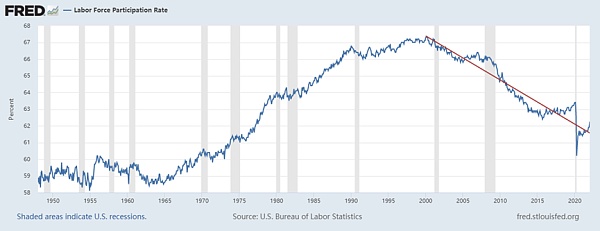

從新聞稿看,聯儲認為價格壓力是普遍的,不只是能源價格,還有勞動力等,目前的失業率已明顯下降(2月份美國CPI通脹率為7.9%,40年來最高;失業率為3.8%,已接近疫前水平)。

聯儲準備從下次會議開始,減少國債和機構債MBS的持有量。

投票委員中,圣路易斯聯儲主席James Bullard投票加息50個基點。

據FT報道,在會后的記者會上,聯儲主席鮑威爾談到加息是為了應對高通脹和緊張的勞動力市場 extremely tight labor market in high inflation.

點陣圖(dot plot,投票委員對利率區間的預測)顯示,聯儲官員比三個月前調高了利率預測,預計2022年剩下的時間還將加息6次,2023年加息至少3次。聯邦基金利率屆時將達到2.8%,高于影響經濟增長的“中性位置”(多數官員預測的中性利率為2.4%)。

美聯儲6月按兵不動的概率降至75.8%:金色財經報道,據CME“美聯儲觀察”:美聯儲6月維持利率不變的概率為75.8%,加息25個基點的概率為24.2%;到7月維持利率在當前水平的概率為58.5%,累計降息25個基點的概率為25.4%,累計加息25個基點的概率為16.1%。[2023/5/16 15:05:05]

美國CPI(1965-2022)

美國勞動參與率(1948-2022)

聯儲新聞稿如下:

March 16, 2022

美聯儲利率決定發布后 美元指數下跌:金色財經報道,美聯儲利率決定發布后,美元指數下跌,最新挫0.504%,報102.630; 歐元兌美元上漲,最新升0.66%,報1.084;美元兌日元下跌,最新挫0.33%,報132.050。[2023/3/23 13:20:48]

For release at 2:00 p.m. EDT

Indicators of economic activity and employment have continued to strengthen. Job gains have been strong in recent months, and the unemployment rate has declined substantially. Inflation remains elevated, reflecting supply and demand imbalances related to the pandemic, higher energy prices, and broader price pressures.

美聯儲柯林斯:通貨膨脹很可能接近峰值,或已經達到峰值:9月26日消息,美聯儲柯林斯表示,通貨膨脹很可能接近峰值,或已經達到峰值。我的預期是,2022年的經濟增長將要慢得多。我們明年的經濟增長也會放緩。(經濟增長放緩)是降低通貨膨脹以及適度增加失業率所需要的一部分,但是目前有很多不確定性。(金十)[2022/9/26 22:30:53]

The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The implications for the U.S. economy are highly uncertain, but in the near term the invasion and related events are likely to create additional upward pressure on inflation and weigh on economic activity.

美聯儲卡什卡利:沒有人向我闡述過央行數字貨幣的好處:美聯儲卡什卡利稱,沒有人向我闡述過央行數字貨幣的好處。(金十)[2021/11/10 6:42:45]

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With appropriate firming in the stance of monetary policy, the Committee expects inflation to return to its 2 percent objective and the labor market to remain strong. In support of these goals, the Committee decided to raise the target range for the federal funds rate to 1/4 to 1/2 percent and anticipates that ongoing increases in the target range will be appropriate. In addition, the Committee expects to begin reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities at a coming meeting.

美聯儲或許已經開始采取措施發行自己的數字貨幣:風險管理公司FiREapps的CEO在寫給《美國銀行家》表示,他認為有跡象表明,美聯儲已經開始采取措施發行自己的數字貨幣。2017年年底,美聯儲的一位高層官員對分布式賬本技術在金融服務領域的承諾表示強烈支持。另一位官員表示,盡管現在談論美聯儲提供數字貨幣還為時過早,但他們已經在開始思考這一問題。[2018/1/11]

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals. The Committee's assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Voting against this action was James Bullard, who preferred at this meeting to raise the target range for the federal funds rate by 0.5 percentage point to 1/2 to 3/4 percent. Patrick Harker voted as an alternate member at this meeting.

— THE END —

時至今日,加密資產正日益成為后現代投資組合的關鍵組成部分。現代投資組合理論(MPT)也已成為構建多元化資產投資組合的主流框架,可以預期將優化整體風險和回報.

1900/1/1 0:00:00全國兩會時間已正式開啟。這是黨的二十大召開之年的兩會, 意義非凡, 也與我們每個人的生活息息相關.

1900/1/1 0:00:00頭條 ▌美聯儲將基準利率上調25個基點至0.25%-0.50%區間3月17日消息,美聯儲將基準利率上調25個基點至0.25%-0.50%區間,為2018年12月以來首次加息,符合市場預期.

1900/1/1 0:00:00近日,知名加密媒體Cointelegraph發布了2022年度加密行業影響力100強,下方為具體名單(包括部分行業名詞與概念),文末還對其中知名人物進行了具體介紹.

1900/1/1 0:00:00幾個月前,在2021 Multicoin Summit峰會上,我作了一個主題演講,強調可組合性是2022年中加密貨幣領域最重要的發展.

1900/1/1 0:00:00作為如今NFT行業最具影響力的玩家之一,Yuga Labs是如何誕生的?它們又為何能如此成功?接下來將如何打造猿猴元宇宙?收購 CryptoPunks 在先,發幣、發空投、預熱游戲在后.

1900/1/1 0:00:00